A Beginner’s Guide into the World of Crypto NFTs

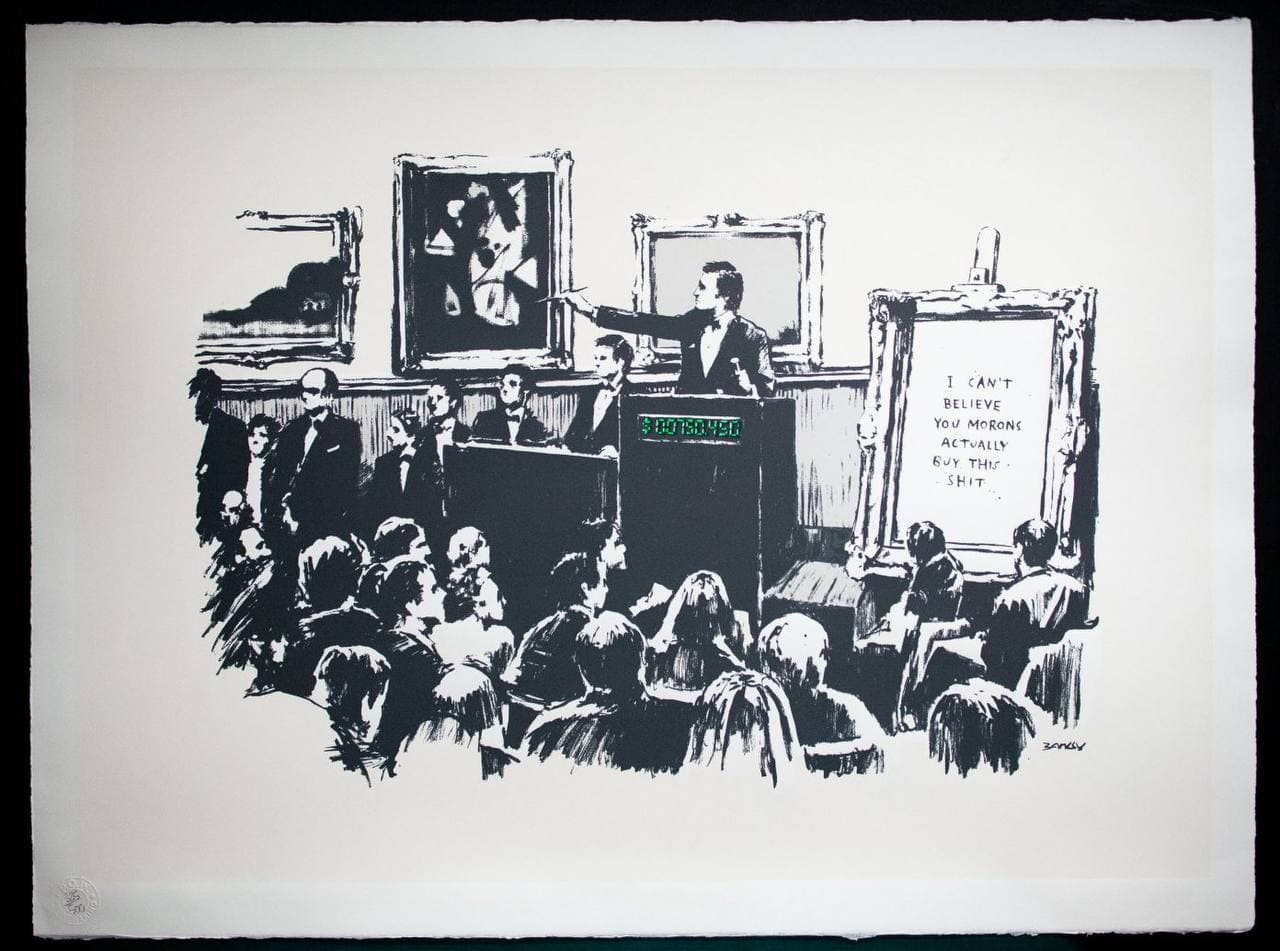

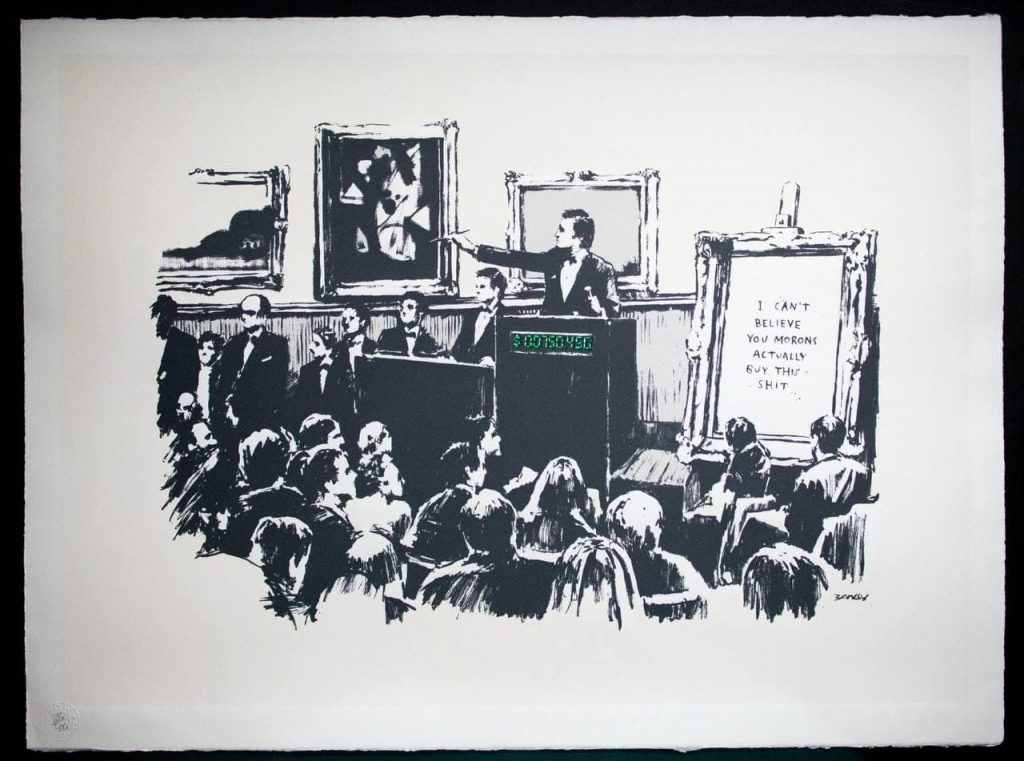

The term NFTs (Non-Fungible Tokens) has been hitting major headlines of late and it’s all for the right reasons. Although not new, NFTs are revolutionizing the way collectors and speculators buy and sell digital collectibles. Perhaps you are familiar with Christie’s auction of a piece of digital art for a whopping $69.3 million?

While it does spell great news for the art and collectibles fraternity, some skeptics believe that it’s all a bubble that’s going to burst. Then again, they said the same thing about Bitcoin but here we are, still going strong.

So if you are wondering what all the fuss is about, you came to the right place. In this article, we are going to demystify NFTs, explaining what they are, how they work, and how you too can start investing in them. Let’s get started.

What Is an NFT?

As you probably are aware by now, the term NFT stands for Non-fungible tokens. According to economics, a fungible asset is an asset with units that can be readily interchanged. A perfect example of this is money.

For instance, you can easily swap a $100 bill with 100 $1 dollar bills and you will still have the same value. However, for anything non-fungible, this becomes impossible. This is because a non-fungible asset has a unique property attached to it that cannot be interchanged with anything else.

For instance, take the Mona Lisa painting. You can take a photo of it or buy a printout of the painting, but there will always be only one original painting. NFTs are kind of the same. They are unique digital assets that can be bought and sold just like any other form of property. However, in this case, they have no tangible form.

Additionally, since they live on the blockchain, they are easy to track. They can prove the authenticity, provenance, and ownership of anything, whether physical or digital. Authenticity can be verified as well as a history of all previous owners, which makes NFTs a “one-of-a-kind” cryptocurrency.

How Do Non-Fungible Tokens Work?

Whenever you purchase a digital asset authenticated by a non-fungible token, you are actually not buying the asset itself, but the certificate of ownership. Anyone else on the internet can download a copy of the file/digital asset. However, only you will hold the contract that states you as the rightful owner of the digital asset.

NFTs try to solve the problem of scarcity for an object that can be easily reproduced. Digital files can be easily and endlessly duplicated. You just have to download it and that’s it, you’ve created another copy. However, with NFTs crypto, a digital certificate of ownership is created and stored on the blockchain, which states you as the rightful owner of the file/asset.

The records cannot be forged as the blockchain ledger is maintained by thousands of computers globally. It works similarly to how blockchain prevents bitcoin from being duplicated or owned by more than one individual. Therefore, when you buy an NFT, you are practically buying the original rights to the asset.

Real World Applications of NFTs

NFTs have opened a gateway into the world of fractional ownership & decentralized finance (De-Fi). As stated earlier, when you purchase an NFT, you are purchasing the original ownership claim on an asset. This in itself has opened up the possibility of several investors purchasing fractional ownership shares of the same NFT.

Fractional ownership also opens up other new possibilities such as:

- More opportunity to own & profit from several items that you really care about.

- More buyers and sellers who can allow NFTs to be traded on decentralized exchanges and not just on NFT marketplaces.

- An NFT’s final price can be influenced by the price of its fractions.

Additionally, NFTs have opened the door for NFT-backed loans that allow you to borrow funds and use NFTs as collateral. Alternatively, as a lender, they allow you to lend crypto to someone and receive an NFT as collateral. In both cases, if the borrower defaults, they lose any claims they have on the NFT and ownership transfers to the lender. The benefits for the lender would be that he/she can lease the NFT to anyone else for additional funds. Also, there’s the probability that the NFT will gather additional value, depending on what kind of NFT it is. For instance, rent if the NFT represents a virtual estate.

Is Crypto Art an NFT?

The short answer is yes. Why do you ask? Well, any artwork that’s linked to an NFT, through unique metadata, is referred to as crypto art. And as recent stats reveal, many artists and digital art creators are laughing all the way to the bank.

Crypto art represents any digital artwork that’s associated with unique and very rare tokens that exist on the blockchain. The main idea behind crypto art is that of digital scarcity. It allows one to buy, sell, and even trade these digital assets as if they were tangible. The reason it works? It’s because crypto art exists in limited quantities.

Earlier examples of crypto art include Crypto Kitties, CryptoPunks, Rare Pepe, Dada, NYC, and CurioCards. If you take a look at the various qualities of crypto art, you will find the same similar qualities in NFTs. In short, Crypto art is what is fueling NFTs. If digital artworks didn’t exist, crypto NFTs wouldn’t have any value behind them.

What’s So Great About NFTs’ Animation?

Recently, the musician Grimes sold some NFTs animations that she made with her brother on a website known as the Nifty Gateway. All the animations were sold within 20 minutes, raking in a total of US$6 million.

However, despite the fact that the animations sold out, anyone could simply right-click on the image and save a copy. The difference between those who copy the file and those who bought the file is that those who bought it, receive authenticity of ownership to those files via NFTs. Later on, these buyers can sell those NFTs to others who may want to purchase.

What’s so great about NFTs is that the original owner has the ability to profit from these animations in the secondary market. With traditional art, once an art piece is sold, ownership transfers from the seller to the buyer and that’s it. When the new owner sells the original art to another buyer for more, the original owner doesn’t benefit from the transaction.

With NFTs, the original seller can set up a fee that he/she gets each time someone resells the art. You practically get paid each time someone resells the art. Additionally, it gives buyers the confidence to purchase NFTs without the fear of forgery or fraud. Since all transactions are recorded on the blockchain, every detail is in full public view.

At the same time, buyers don’t have to worry about storage or accidental damage to the art piece. Since the NFTs are digital, they don’t necessarily have to store any physical artwork. Additionally, this also introduces a new concept where a single piece of art can have different co-owners. Which can enable just about anyone to diversify their portfolio in art and collectibles without necessarily having to purchase an entire piece.

Crypto Kitties and Other Expensive NFTs

As you have probably learned by now, any digital asset that creators want to make unique can become an NFT. The first instance of such came via the Crypto Kitties game. Players could collect and breed unique digital cats. Every Crypto Kitty is unique and is digitally stored on the Ethereum blockchain.

The Crypto Kitty Dragon was the first Crypto Kitty to sell at a record 600 ETH, which at the time was $170,000. This paved and set the way for the entry of new and expensive NFTs into the market. Today, we have all manner of items selling via NFTs. In February of this year, a virtual piece of land on the Axie Infinity gaming platform sold for 888.25 ETH. That’s about US$1.5 million.

Around the same time, Chris Torres, the designer of the now infamous Nyan Cat, sold it for about $590,000. Recently, someone made a purchase for an NBA video highlight that features LeBron James for US$208,000. Let’s not forget Jack Dorsey who sold his first tweet for $2.9 million on March 22.

Pablo Rodriguez-Fraile had bought a 10-second piece of art from Beeple in October 2020 for US$67,000. This year, he sold it for a staggering US$6.6 million. Perhaps the most iconic NFT sale was that from the auction house Christie. Beeple’s unique digital artwork known as Everydays: The First 5000 Days. It sold for a record US$69 million. Clearly, the NFT market is fast becoming a lucrative market.

Is Every Non-Fungible Token Unique?

In the section, “what are non-fungible tokens?”, we referred to NFTs as “unique digital assets.” As we will see much later in the article, every non-fungible token represents something unique that sets it apart. It’s because of this uniqueness that NFTs are able to command and generate value. It’s comparable to owning one-of-a-kind art or a collectible.

For instance, if two people have one bitcoin each, they can exchange the bitcoins with each other, and they will have the same value of bitcoin. However, with NFTs, you can’t do that. Every non-fungible token is unique in itself. Each NFT represents a unique value. It’s similar to how the Mona Lisa is unique, thus why it’s priceless.

Even if you purchase a print version of the Mona Lisa, there is only one original owner who has the original physical painting. If both of you were to sell your Mona Lisa’s, only the owner of the original piece will make a legitimate sale as the authenticity of the Mona Lisa can be easily tracked down via the blockchain.

This uniqueness simplifies digital ownership and makes the real owner easily identifiable. Thus, making every non-fungible token unique.

Where To Buy NFTs?

You can purchase NFTs on a number of platforms. Whichever platform you choose depends on what kind of NFT you want to buy. You will require a crypto wallet specific to that platform which you will fill up with crypto.

As you’ve probably seen by now some pieces are starting to hit mainstream auction houses. For instance, Beeple’s Everydays – The first 5000 days sold for a record 69.3 million at Christie’s auction. Because of increased demand, you’re better off registering an account with money, as these pieces go as quickly as they come.

In case you are wondering where to buy NFTs, here is a list of some of the most popular NFT marketplaces. They include:

- OpenSea

OpenSea is recognized as one of the largest NFT marketplaces right now. Founded in 2018, it boasts a wide number of NFTs including but not limited to trading cards, sports, collectibles, virtual worlds, digital art, censorship-resistant domain names, etc.

The platform charges a 2.5% fee on the price after every sale. Recently, the SNL team auctioned their NFT skit version of their “What the hell’s an NFT.” It was bought by an anonymous buyer going by the name Dr_Dumpling for 172 ETH which translates to around $350,000.

- BakerySwap

BakerySwap is a decentralized exchange on the BSC (Binance Smart Chain). It has its own native token known as BAKE. Its NFT supermarket hosts a plethora of items such as digital art which can be paid for using the BAKE native token.

Minting and selling digital artwork on the platform could not be any easier. You simply upload your original artwork, verify yourself as the artist, fill in a few details regarding the art, and click “mint.” The artwork then gets added to the NFT marketplace.

- Rarible

Rarible as an NFT marketplace offers quite a number of NFTs. Using the platform’s native token, RARI, users can easily purchase NFTs in various forms such as books, movies, music albums, memes, or digital art.

The ultimate goal of Rarible is to go completely decentralized, where all decisions & rights will belong to the platform users. The cool thing about Rarible as a creator is that you can give sneak peeks of your project to people but limit the full project to the final buyer.

- SuperRare

SuperRare works with a small number of artists that it handpicks itself. For this reason, there is a high barrier to entry into the market as a creator. However, if you’d like to join them, you can still submit your profile through a form on their website.

All transactions on the platform are made using Ether. For any sales made on the platform, SuperRare charges a %25 commission. For any secondary sales, you receive a 10% royalty as passive revenue if and when your art gets sold in the market again.

- Nifty Gateway

Unlike SuperRare which is highly restrictive to entry, Nifty Gateway allows access to just about anyone. This was its primary mission. You can instantly purchase any crypto collectible you want using a credit card.

Nifty teams up with top brands and artists offering limited-edition collectibles in drops that often take place every three weeks. Additionally, you get to choose where you want to store your collectible. Also, any tokens you hold on the platform can be withdrawn straight to your wallet or an external account.

- VIV3

VIV3 creators believe that the world is on the verge of shifting from physical ownership to digital ownership. Therefore, VIV3’s mission is to empower individuals to create, trade, and own digital creations created on the Flow blockchain. Brands, game studios, or artists can mint NFTs representing their digital creations. These can then be bought by fans, gamers, digital asset traders, and speculators.

- Axie Marketplace

Axie is a Pokemon-inspired virtual pet universe where users can use their cute characters known as Axies in several games. Users in the marketplace can sell their Axies in an auction. Over time, the price can either increase or decrease, depending on the seller’s intentions.

- NFT Showroom

NFT showroom is built on Hive. Hive is a speedy and free blockchain that simplifies the creation and collecting process. The platform has gained a lot of traction with the Hive community as it offers an affordable alternative for both creators and collectors. They charge a 10% commission for the first sale & 5% commission for secondary sales, with 5% going to the original artist.

All you have to do to get on NFT Showroom is to create a Hive account and Hive Keychain. You can then tokenize or purchase any digital artwork using the platform’s token, SWAP. The benefit of NFT Showroom is that it’s open to all, and welcomes all sorts of art styles and skill levels.

- Foundation

Foundation brands itself as the “new creative economy” that’s primarily focused on digital art. Whenever there is a secondary trade on Foundation, an artist receives 10% of the selling price every time the artwork gets sold.

The platform’s most popular sale was that of electronic music producer, Richard D. James otherwise known as Aphex Twin, who sold an audio-visual collectible for over 72 ETH. That was around $127,000 at the time.

What Can I Buy as NFTs?

NFTs can represent virtually any kind of asset that’s real or intangible. Some examples include:

- Music

- Animations

- Collectibles such as trading cards

- Virtual Land

- Artwork

- Celebrity Tweets

- Video footage of iconic sporting moments

- Real-world assets such as real estate, cars, designer sneakers, gold, etc.

- Virtual items in games such as weapons, avatars, skins, virtual currency, etc.

What’s To Pick at NFTs Market?

A lot of the hype in the NFT sphere is around collectibles. These include items such as sports cards, digital artwork, and rarities. One of the most hyped is the NBA Top Shot. This is a place where you can collect NFT NBA moments in a digital card form. Some have already sold for millions of dollars.

Recently, Jack Dorsey, the CEO of Twitter, shared a link to a tokenized version of the first tweet ever. It contains the words “just setting up my twttr.” The NFT version of this first tweet ever has already been bid up to a whopping $2.5 million. Other NFTs are distributed in the market as follows:

- 41% is in the gaming industry

- 29% is in collectibles

- 13% is in real-estate

- 7% is in collectible cards

- 6% is in domain names

- 4% is in art

With options such as these, you can pick out just about anything that you want. As long as there is demand, you can make an investment today and make a killer profit once you sell ownership to someone else later.

How To Invest in NFTs?

If you’re wondering how you can get into NFTs, we’ll show you how. You’ll most likely need to use ETH. There are two ways that you can go about this, the first way is to invest in the underlying infrastructure that supports NFTs. This means investing in Ethereum and/or the smart contract bundle.

The other option would be to create a wallet, depositing some ETH and then hitting up NFT markets such as SuperRare to find the best digital artwork. Through the different sites available, you’ll be able to see the various prices and the price history or ownership of the artwork.

Just remember, the NFT market is decentralized. Additionally, the Majority of the NFTs are highly diverse, which means they have different value drivers. You just can’t jump into the market and start buying things.

So if you’re just buying to see what the fuss is about, we suggest starting with a lower price point before committing to expensive NFTs.